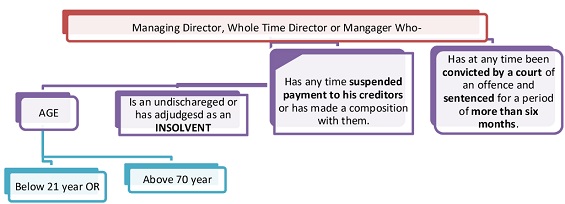

What is Managing Director under Companies Act, 2013?

Section 2(54) of the Companies Act, 2013 provides that ‘managing director’ means a director who, by virtue of the articles of a company or an agreement with the company or a resolution passed in its general meeting, or by its Board of Directors, is entrusted with substantial powers of management of the affairs of the company and includes a director occupying the position of managing director, by whatever name called.

A Managing Director is an ordinary director entrusted with special powers . According to Palmer, a managing director, in great majority of cases combines the position of director and of employee. The words ‘substantial powers of management specifically excludes certain acts from its purview.

Therefore, except the excluded acts, the managing director has power and privilege of conducting the business of the company in accordance with the memorandum and articles of association of the company.

Procedure For Appointment Of Managing Director Where The Age Is 70 Years Or More

1. In case of appointment of managing director/whole time director, other than the existing directors, first they will be appointed as an additional director by the directors of the company. (In case of appointment as an additional director, complete the formalities of appointment of an additional director).

2. Arrange the following documents from the appointee:

- Director Identification Number and Digital Signature Certificate.

- Consent in writing to act as managing director/whole time director.

- Disclosure of interest by director in Form MBP-1.

3. Prepare notice of board meeting along with draft resolution(s) to be passed in the board meeting.

- Send notice of board meeting to all the directors at least 7 days before the date of board meeting or in such manner as prescribed under section 173(3) of the Companies Act, 2013 and clause 1 of the Secretarial Standard-1.

4. Convene board meeting and pass the following resolutions:

- Appointment of additional director, if required.

- Appointment/re-appointment of a director as managing director or whole time director of the company subject to members’ approval by way of special resolution.

- Authorization to any director for necessary filing of e-form(s).

- To fix-up the day, date, time and venue for the general meeting.

- Approve the notice of general meeting with explanatory statement and explanatory statement annexed to the notice shall indicate the justification for appointing such person.

5. Prepare draft minutes of the board meeting and circulate, within a period of fifteen days from the date of conclusion of that meeting, to all directors, by hand/speed post/registered post/courier/e-mail or by any recognized electronic means, for their comment(s).

6. Obtain disclosure of interest by director under section 184 of the Companies Act, 2013 in Form MBP1. [in case of re-appointment of existing director or in case of person appointed as an additional director].

7. File e-Form DIR-12 along with attachments with the Registrar of Companies regarding appointment of director as an additional director and simultaneously as a managing director/whole time director.

8. File e-form MGT-14 for board resolution along with attachments with the Registrar of Companies regarding appointment of Managing Director.

9. Send notice of general meeting to all directors, shareholders, auditors, secretarial auditors and Debenture Trustee, if any, of the company at least 21 days before the date of general meeting. However, notice may be given at a shorter period of time if consent in writing is given thereto, by physical or electronic means, by not less than ninety five percent of the members entitled to vote at such meeting in case the matter is considered in Annual General Meeting, however, if the matter is taken in Extra Ordinary General Meeting, then shorter notice of general meeting may be given subject to:—

(i) in case company have share capital, consent of majority members entitled to vote and who represent not less than ninety-five per cent of such part of the paid-up share capital of the company as gives a right to vote at the meeting; or

(ii) in case company have no share capital, consent of members not less than ninety-five per cent of the total voting power exercisable at that meeting.

In case resolution is to be passed by Postal Ballot, please follow the procedure of passing of resolution through Postal Ballot. (However, private companies can opt their own regulations with respect to notice of General Meeting.)

10. Convene general meeting to pass the special resolution for appointment of person as managing director/whole time director. Further, if no such special resolution is passed but votes cast in favour of resolution is more than the votes cast against the resolution, than board must file an application to the

Central Government which after satisfaction can allow to appoint such person.

11. Maintain proper record for:

Total number of members present at the meeting with their shareholding pattern.

Members who voted in favour of the proposed resolutions and number of shares held by them.

Members who voted against the proposed resolutions and number of shares held by them.

12. Prepare draft minutes of shareholders’ meeting and for finalization, send the draft minutes to the chairman of that meeting.

Minutes of the shareholders’ meeting shall be signed and dated by the chairman of that meeting or in the event of the death or inability of that chairman, by any director, who was present in that meeting and also duly authorised by the board of directors for the signing of the meeting, within thirty days from the date of conclusion of the shareholders’ meeting.

13. File e-Form MGT-14 along with attachment with the Registrar of Companies within 30 days of passing of special resolution.

14. In case, the special resolution is not passed, the company has to obtain approval from Central Government for the same.

15. In case, approval is required from the Central Government, file the application along with sound justification for appointment of a person as a managing director/whole time director who has attained the age of 70 years.

16. Obtain approval and inform the appointee about completion of procedure of his/her appointment.

17. Make necessary entries in the respective registers and records of the company.